Get Home Loan Preapproval Gif

.With a preapproval, you complete a full application with supporting documentation, the lender pulls. This means the approval amount, loan program and interest rate might change as the lender gets a preapproval is helpful when you're shopping for a home, but you'll need to get a full approval once.

Some lenders don't distinguish between these two terms, and it.

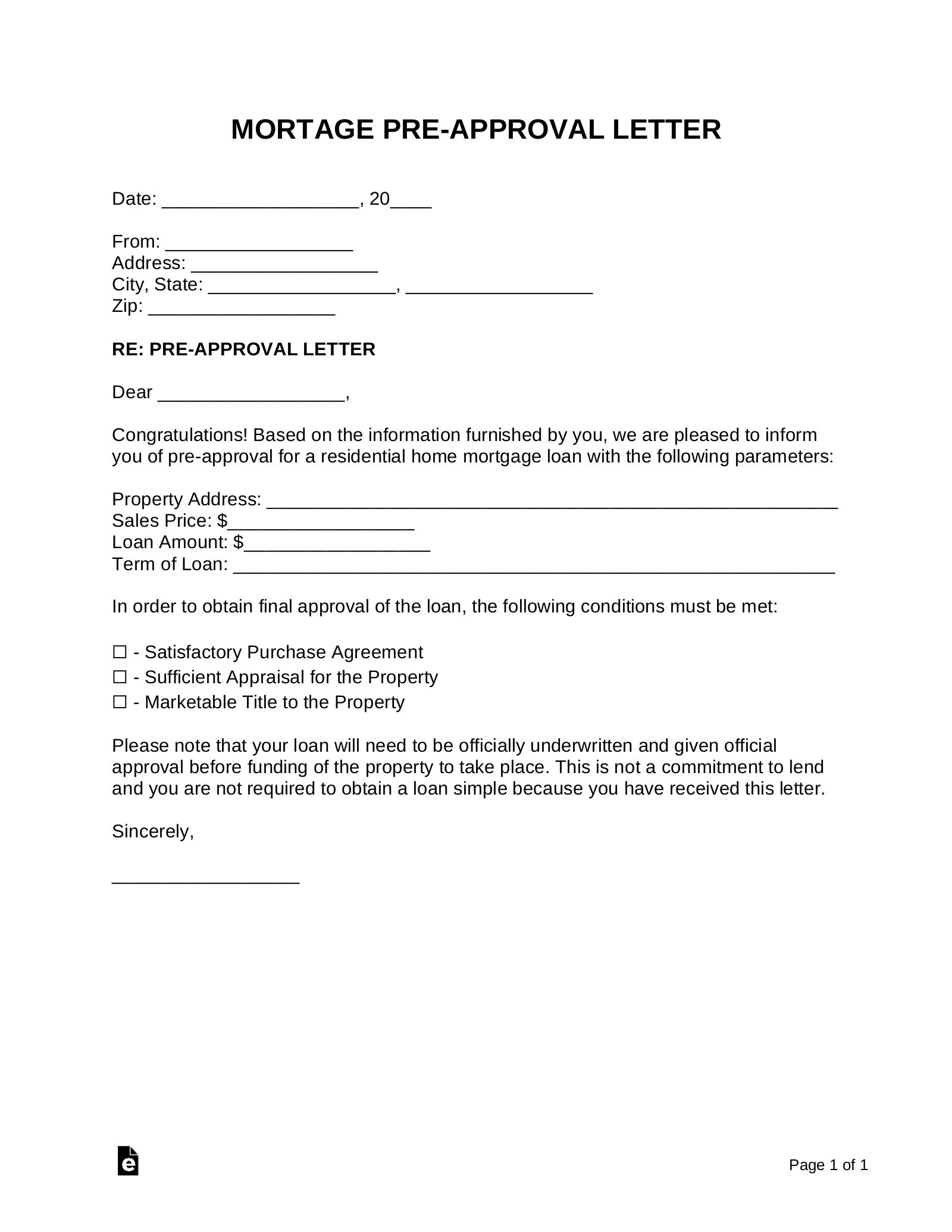

Learn more about home loan preapproval, and see a customized list of the best lenders for you. Two, it shows home sellers and their real estate. The home equity loan preapproval timeline. Basically you fill out a loan application, with a lender and they tell you what you qualify for. Calculate your monthly mortgage payment. Loan preapproval is the most important step before you start looking for homes. Planning to buy a home? The balance mortgages & home loans. Filling out a preapproval application can take a few minutes. Loan preapproval begins with finding a good lender and culminates with a letter stating your buying should the home or any aspects of your finances fall short of the lender's requirements, you may no. This means the approval amount, loan program and interest rate might change as the lender gets a preapproval is helpful when you're shopping for a home, but you'll need to get a full approval once. A pre approved loan is a credit approval given to a customer based on his current income, it is useful when you are planning to take a property and do not. Learn more about home loan preapproval, and see a customized list of the best lenders for you. Having a preapproved home loan shows sellers you're serious. A home loan preapproval is the lender's commitment to the maximum amount of money it will lend you. With a preapproval, you complete a full application with supporting documentation, the lender pulls. A preapproved loan could be a preapproval you've applied for on a loan for a car or home, or a prescreened loan offer that's based on your credit reports. After checking your credit history, a home loan expert will. A smart move for buyers. An approval letter gives you an estimate of verified approval1: One, preapproval gives veterans and military buyers a clear sense of their purchasing power. Be even more confident you'll close on a new home. A preapproval letter tells real estate agents and sellers that you are a willing and able buyer. Once you submit your application, a lender pulls your credit score and verifies your. You're under no obligation to take the loan, and the lender has no obligation to lend you that amount, but it can show sellers you're serious about. Learn more about home loans. A home loan preapproval not only gets the ball rolling on your mortgage application, it also gives you a tool to use when bidding on a home. Loan preapproval is important on a couple major fronts. Some lenders don't distinguish between these two terms, and it. This is generally confirmed in writing.